What Does Insurance Agent Job Description Do?

Wiki Article

The Best Guide To Insurance Ads

Table of ContentsExamine This Report on Insurance AsiaThe Insurance Asia DiariesInsurance Code for BeginnersA Biased View of Insurance CompaniesInsurance for DummiesThe 8-Minute Rule for Insurance Asia Awards

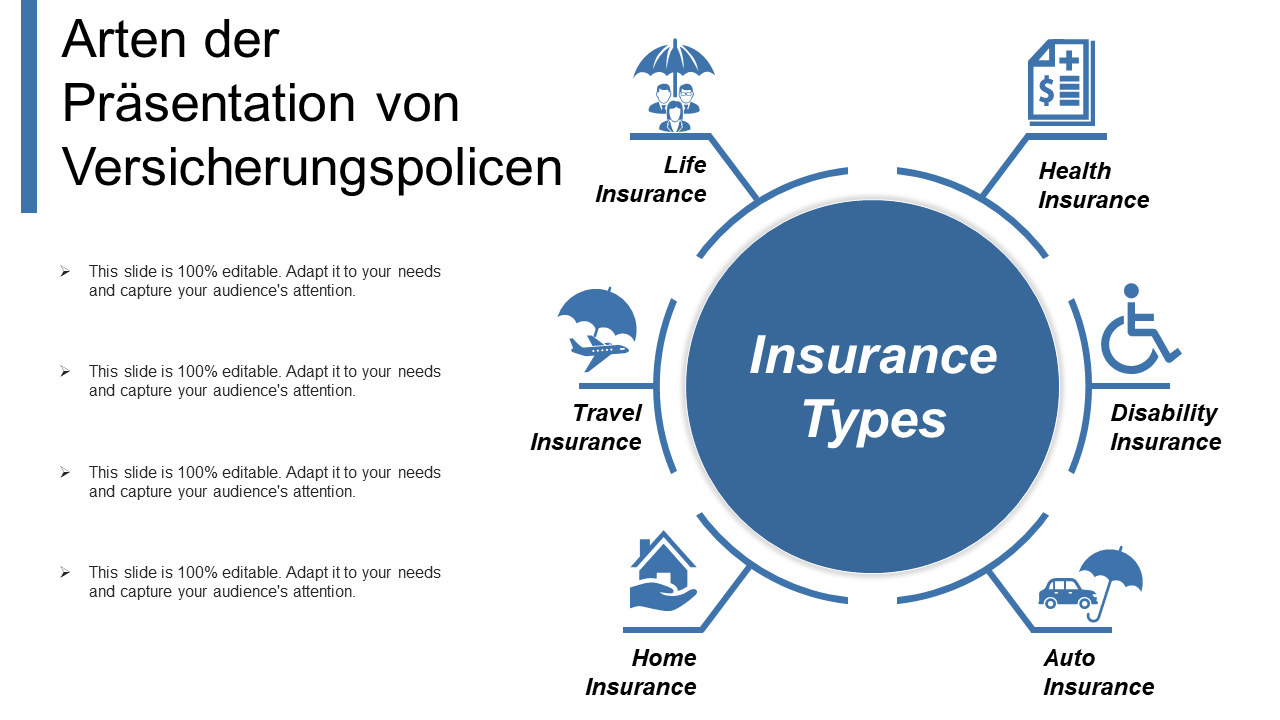

Insurance coverage offers peace of mind versus the unanticipated. You can find a plan to cover almost anything, however some are a lot more important than others. As you map out your future, these four kinds of insurance policy ought to be firmly on your radar.Some states additionally need you to carry individual injury defense (PIP) and/or without insurance motorist coverage. These insurance coverages spend for clinical expenditures connected to the incident for you and also your passengers, despite who is at fault. This additionally aids cover hit-and-run accidents and crashes with drivers who do not have insurance coverage.

This might come at a greater cost and also with much less protection. That's since it shields you versus expenses for residential property damage.

The 7-Second Trick For Insurance Companies

In case of a robbery, fire, or disaster, your occupant's policy ought to cover many of the expenses. It may also assist you pay if you need to stay somewhere else while your home is being repaired. And also, like home insurance, tenants supplies responsibility security. 3. Medical Insurance Health insurance coverage is one of one of the most crucial kinds.

9 Easy Facts About Insurance Asia Explained

You Might Want Impairment Insurance Coverage Too "As opposed to what several individuals think, their residence or cars and truck is not their best possession. Instead, it is their ability to earn an earnings. Numerous professionals do not insure the opportunity of a disability," said John Barnes, CFP and also proprietor of My Family Life Insurance Policy, in an email to The Balance.You must likewise assume regarding your needs. Talk with certified agents to figure out the very best methods to make these plans function for you. Financial organizers can offer suggestions about various other typical kinds of insurance that need to additionally become part of your like this economic plan.

Health Insurance policy What does it cover? Wellness insurance coverage covers your essential medical costs, from medical professional's visits to surgical procedures. In addition to coverage for health problems and injuries, medical insurance covers preventative care, such as month-to-month check-ins as well as tests. Do you require it? Health insurance policy is perhaps one of the most important sort of insurance.

Insurance - The Facts

You most likely do not require it if Every grownup need to have wellness insurance policy. There are several various kinds of vehicle insurance check my site policy that cover various circumstances, including: Liability: Responsibility insurance coverage comes in two kinds: physical injury as well as building damages obligation.Accident Defense: This sort of protection will cover medical expenditures associated with driver and also guest injuries. Collision: Crash insurance will certainly cover the price of the damages to your automobile if you enter a mishap, whether you're at mistake or otherwise. Comprehensive: Whereas crash insurance policy only covers damage to your auto created by a crash, comprehensive insurance covers any kind of car-related damage, whether it's a tree dropping on your cars and truck or vandalism from unruly community kids, for example.

Always be on the hunt for cars and truck insurance price cuts when you're looking for a plan. There are lots of discounts you may be qualified for to lower your month-to-month expense, including risk-free motorist, married motorist, and multi-car discount rates. Do have a peek here you require it? Yes! Every state needs you to have vehicle insurance policy if you're going to drive a lorry - Insurance.

7 Simple Techniques For Insurance Advisor

You probably don't need it if If you don't own an automobile or have a motorist's certificate, you won't need cars and truck insurance coverage. House Owners or Renters Insurance Coverage What does it cover?You might require extra insurance policy to cover natural catastrophes, like flooding, quakes, as well as wildfires. Occupants insurance covers you against damage or theft of individual products in a house, and also in many cases, your vehicle. It additionally covers responsibility costs if a person was injured in your apartment or condo or if their belongings were damaged or taken from your apartment or condo.

Do you require it? House owners insurance coverage is definitely vital because a home is frequently one's most beneficial property, as well as is commonly needed by your mortgage loan provider. Not only is your residence covered, however the majority of your valuables and also personal belongings are covered, too. Occupants insurance coverage isn't as crucial, unless you have a huge apartment that has lots of belongings.

6 Easy Facts About Insurance Asia Described

Do you require it? Life insurance coverage is the kind of insurance that the majority of people wish to avoid considering. It's exceptionally essential. If you have a family, you additionally have an obligation to make certain they're offered in the event that you pass before your time, specifically if you have youngsters or if you have a partner that's not working.

Report this wiki page